In album: mortgage calculator uk

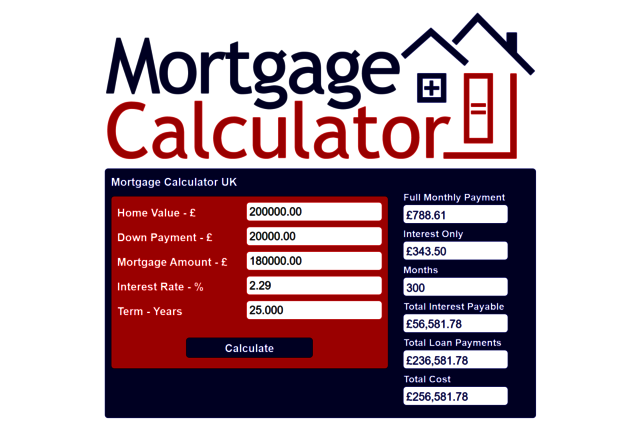

Preparing Your Finances to Apply for a Mortgage Whether you are buying your first home or your third home, you will quickly understand that it is vital that you do not rush into applying for a mortgage when purchasing a property. The process does not start with simply selecting a home within your budget and often starts months in advance as you financially prepare for the process. These days, it can be more difficult due to lockdown and the pandemic. However, there are a few things to consider as you are preparing your credit and finances for a mortgage application. Before you apply for a mortgage, you must be registered to vote. For lenders to confirm your address, you need to be registered on the electoral roll. Doing so will also help the financial lender trace your credit history. If you are not registered on the electoral roll, it is challenging for the lender to get enough information to progress your mortgage. It may even be impossible. So, when you are getting ready for a mortgage, voting is the most crucial step. Next, be selective about your credit applications. If you “apply for everything†to get approved for something and end up with too many rejected applications, it can reflect poorly on your mortgage application. This suggests to the lender that you are not creditworthy or desperate to get the money for a mortgage. You may raise unnecessary questions about your ability to make repayments, and the lender is then must less likely to approve your mortgage and allow you to purchase your next home. Review your credit history and credit score. Before you approach a lender, check your credit score. If it isn’t where it should be, do not apply and begin to raise your credit score. When you feel that there are inaccuracies in your credit history, now is the time to fight such incorrect information. If you have debt, begin to pay your debts and work on your credit score to better your financial situation. You can speak with a financial advisor to see if any credit habits should be improved upon to help you secure a mortgage loan for a new home in the future. They can help you cut unnecessary borrowing, reduce the debt-to-income ratio, and ensure that you pay bills on time. If you have older credit accounts, you should keep these open. These old accounts are able to demonstrate to lenders that you can make repayments and complete loans or pay off credit cards over a sustained period of time. However, you can close inactive accounts as they show lenders that you have too much access to credit that you may not need. If you have out-of-date financial associations, remove these from your financial history as they could negatively affect your ability to obtain credit. You can use Mortgage Calculator resources to calculate down payment, mortgage amount, and loan terms. Other online resources, such as Equifax, help you understand your credit score and history before applying for a mortgage. There are many factors to go through before you approach a lender for a mortgage, and each one must be carefully considered before they will find you creditworthy and help you purchase a new home. https://www.mortgagecalculator.uk

Comments

Add Comment

Add Comment

Please login to add comments!